— Last week I received an email from a real estate investor that just now (?) discovered that her “property tax for a 392 sqft studio went from $1,200yr to over $6k per year for 2018 & 2019.” She blamed her realtor and property manager for not having informed her about a 2017 change in the law.

She complained that “the city ripped her off by $11,000″ because “she didn’t know.” She wrote that she “wished she would have found our blog in 2017.” It could have saved her the $11K!

Knowledge equals power to help you accomplish your goals.

Ask Yourself Two Questions:

- How would you feel if your realtor could have saved you $11K by simply keeping you up to date?

That’s why you should work with us. Not ready yet? At least sign up for our monthly newsletter at the top right of this page. It’s all free. You won’t miss out again.

- Do you think you could benefit from working with a team of realtors that has the hands-on real estate investment experience that you are trying to gain?

Of course, you would. Why would you seek real estate investment advice from anybody that has no real estate investment experience?

By writing here, we are trying to be useful. And writing clarifies thinking which helps us too. But we don’t just write about this stuff. We are dedicated realtors with the experience to back it up, assisting owner-occupants, investors, buyers, and sellers. We are here to help and earn your business. Contact us today.

________________

Perhaps you too are dreaming about investing in Hawaii real estate for long-term wealth creation. We are committed to sharing tips and tools that help you get started and grow to the next level. May you benefit in some way.

We care to see you succeed regardless of where you are currently on your journey.

Willingness is not enough. In addition, you need to be financially able and have a long-term vision with a commitment to learn, grow, and work towards achieving your goals. It’s simple, but not easy unless you have the right plan.

You must take the necessary action.

You Need More Than A Vision And A Plan

Many new real estate investors appear to remain stuck in theory. They get caught up analyzing income statements and comparing CAP rates while forgetting the basics.

There are dreamers and talkers versus doers. We are here to help you become a doer.

“Vision without action is merely a dream. Action without vision just passes the time. Vision with action can change the world.” ~ Joel Arthur Barker

Doers don’t wait. Instead of ‘wanting to do,’ you ‘commit to doing’ and start now with the resources you have available today.

Doers don’t always know all the necessary steps to achieve their goals. Instead, you develop the confidence to learn the required steps and build on your success along the way.

Doers don’t make excuses based on external circumstances. As a doer, you know that current limitations are only temporary, and with a growth mindset, you can learn new necessary skills.

It has been done before, so you can do it too. That’s enough to start. You learn as you go, refine your skills, recalibrate your mental representation, and use deliberate practice with extraordinary effort moving towards accomplishing your goals.

Eventually, you become unstoppable.

See related article: The Psychology Of Buying Hawaii Real Estate And The Three “Ps” That Are Holding You Back

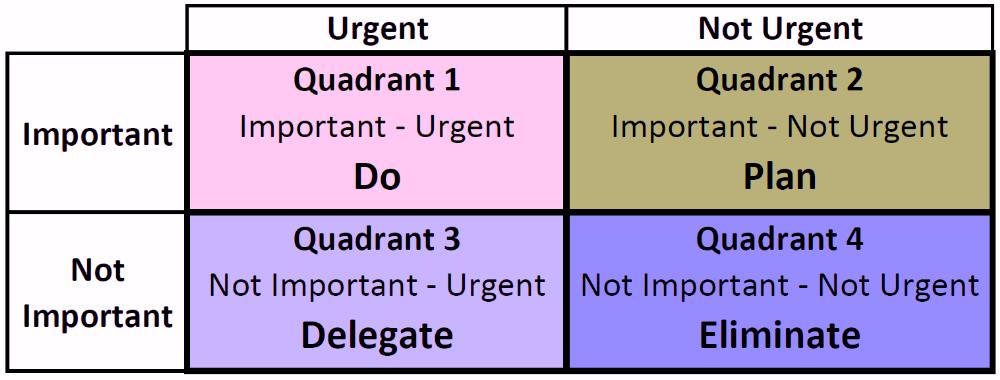

In his book, ‘The 7 Habits of Highly Effective People’ Stephen Covey explains the 4-quadrant concept of how to decide on the immediate next steps to take that are consistent with your values, mission, and purpose.

The immediate next steps fall into Quadrant 1, at the cross-section of important & urgent.

- Quadrant 1: Focus on completing this task now.

- Quadrant 2: Plan time to complete this task by a certain time/date

- Quadrant 3: Delegate

- Quadrant 4: Eliminate

Tie Your Shoelaces Before Running The Race

Don’t trip and fall. Before you get too excited about analyzing income statements and calculating CAP rates, I recommend some basic financial house cleaning. Sharpen the contradiction.

Focus on tasks within Quadrant 1 and implement these decisive first steps and habits:

- Pay off your monthly credit card bills in full, ..on time, ..every time. Getting rid of any revolving credit card balance gives you a risk-free guaranteed rate of return equal to the interest rate on the credit card you would otherwise be paying. You must mark payment due dates on your calendar, so you never get charged a late fee.

- Finish your overdue tax return and get pre-approved, unless you have all cash and don’t need a mortgage loan. Set aside sufficient emergency cash reserves.

- If you need to get the downpayment from the sale of another property, then:

- a) list your property for sale, and

- b) get your property into escrow with a defined scheduled closing date.

See related article: Buy Before Sell vs Sell Before Buy – Best Strategy For A Sideways Move In Real Estate

- Continuously maximize your retirement account contributions. If your employer offers a 401K plan, max out your allowable contributions. If you are lucky and your employer matches contributions, take advantage of it. 100% matching contributions are an instant 100% guaranteed return on your investment. This is huge. No 401K plan? Then max out your SEP IRA, regular IRA, and Roth IRA contributions.

“Far too many good brains have been afflicted by the pointless enthusiasm for useless knowledge.” ~ Seneca

The knowledge that does us good is worthwhile. Everything else is trivia and noise.

Phase I – Ramen Profitable

Perhaps you already mastered the basic stuff. You already own a couple of investment properties producing positive cash flow supplementing your working income. You reached phase I, where passive cash flow pays some of your living expenses.

See related article: 7 Residential Real Estate Investment Strategies

But perhaps you are more ambitious and want to go beyond ramen profitable. You want to continue growing your portfolio. You want to reach phase II.

Phase II – Financial Orbit

You want to multiply your passive income to the point of entirely replacing your working income.

You want to scale and reach ‘financial orbit’ where your passive real estate investment income pays all your living expenses and sustains your ideal lifestyle for the rest of your life.

It’s called reaching ‘critical mass.’ At that time you work for pleasure only.

See related article: Should I Pay Down Or Pay Off My Mortgage? Or Should I Buy More Investment Properties?

How Do You Scale Your Portfolio And Reach Phase II?

“Rome wasn’t built in a day, but they were laying bricks every hour.” ~ James Clear

Discipline and long-term commitments are difficult for many. Reaching phase II requires ‘fractionalizing’ your big goal into manageable action steps and getting organized by using simple tools.

Simplify, standardize, and automate (SSA) so that your investment portfolio works for you, instead of you working for your portfolio.

Real estate investments need to be managed and run like a business. But the business does not have to run you. Ideally, you want to design your life that your business largely runs itself with minimal time required on your part.

You can’t grow your business if you burn out. A few simple tools can help you scale without getting overwhelmed.

Paperless – E-Statements

The more real estate you own, the more documents and statements you will have to process. – Simplify.

Switch entirely to paperless and cloud storage. Never look back. No statement or invoice gets missed even when you are traveling thousands of miles away from your mailbox.

Choose to forgo papercuts and wasting hours of opening paper envelopes. Stapling, hole-punching and filing papers into monstrous filing cabinets are a waste of time. Make a game with yourself how quickly you can update your digital folders every month.

All statements, documents, invoices, and notifications should be handled via email and cloud storage. With the push of a button on your smartphone, you can review and file your statements in the cloud. In a fraction of the time, you can access all your digital files from your cloud folders instead of digging through deep storage filing cabinets.

Maintain a standardized system to label all your files and folders. Then you will be able to always find what you are looking for just with a simple ‘search tool,’ e.g. ‘Ctrl+F.’

Autopay

The privilege of owning real estate and collecting rental income comes with great responsibilities. You need to pay regular recurring expenses. These could include monthly mortgage payments, maintenance/HOA fees, utility bills, and cleaning fees.

Set up ‘autopay’ from your checking account for all your bills. This authorizes the vendor (mortgage lender, HOA, utility company, etc) to automatically draft so you never miss a payment. Imagine owning ten or even 100 properties and having to write checks and lick stamps and envelops every month. That’s no fun.

I use only one checking account at a local credit union and pay all bills with autopay. Everything flows through just one checking account.

At two other banks where I had obtained mortgages, I maintain checking accounts just to autopay their respective mortgages. Those banks had offered a closing cost credit, provided I set up a checking account with autopay at their bank. My main checking account at the credit union auto-transfers every month just enough money into the other two bank accounts to autopay these mortgages.

Match the autopayment dates with the respective due dates. Consider the grace periods for all your mortgage payments and maintenance/HOA fees. Many of my own bills get auto-paid on the 10th or the 15th of each month, within the grace period, instead of the 1st of the month.

You need to know exactly a) the total dollar amount that gets auto-paid from your checking account and b) the exact day of the autopay drafts. Mark it in your calendar and make sure you always have enough money in your checking account.

Regretfully, some bills, e.g. property taxes, GET/TAT/OTAT rental income taxes, and even some insurance premiums cannot be paid with autopay. Instead, second best, you might be able to pay online.

However, some online payment options charge an extra processing fee. E.g. Honolulu property taxes can be paid conveniently online with a credit card, but the online processing fee is a rip-off. That’s one of the very few instances where I still write a check and mail it in. Just make sure you don’t miss the deadline.

Mark your calendar with all due dates of bills that are not on autopay. Keep accurate records of your checking account balance so that you never overdraft your account. Never miss a payment or incur a late fee or penalty.

Electronic Deposits

More fun than paying bills is collecting rent. Of course, whenever possible you also want to have your rental income deposited electronically.

Years ago my bank would habitually put my out-of-state rental income check on hold for 5-business days to clear. That’s after I already had to wait 5-business days for the out-of-state rental check to arrive in the mail. No good.

Productivity requires three key resources:

- Energy

- Money

- Time

‘Time’ is the most precious resource of all. It is the only one of the three that is not renewable. Wasted time is gone forever.

Time gives us the freedom to pursue what we enjoy doing most.

Do you really want to wait for the mail, go to the bank and wait in line for a bank teller to process your deposit? Think again and review the 4-quadrant concept above.

Alerts

Monitoring your accounts with an app on your phone is good, but receiving live alerts is better.

All auto-payments from my checking account trigger an email and text alert. Equally important, all auto-deposits into my accounts also trigger an alert.

I also set up alerts if any account balance inadvertently drops below a predetermined minimum balance.

I use two credit cards for my daily living expenses. Any credit card purchase triggers an email and text alert.

This is basic fraud prevention and often reduces the need for a paper receipt for small transactions. It seems like common sense, but it’s not always common practice.

Track Your Income And Expenses

Wouldn’t life be more fun if you could minimize the time and effort you spend on managing your rental properties? Perhaps dealing with tenant issues is not your cup of tea. I can relate.

There is a time when you want to enjoy the fruits of your labor and investments, and also maximize your time towards living your life’s purpose. A good property manager can help simplify your life, give you peace of mind, and free up precious time for you to pursue what you enjoy most.

That’s the goal. However, in reality, even when you have an excellent property manager, at times you might need to manage expectations with the manager, and you always need to keep track of your investments.

“If you can’t measure it, you can’t improve it.” ~ Peter Drucker

At one time I owned investment properties spread out over three different states. Because the properties were also in different cities, I received monthly property management statements from six different property managers.

A certain degree of diversification is crucial for risk management. But can we find a middle ground between simplification and efficient time management, and still enjoy maximum income and diversification? Of course, we can.

Tracking income and expenses becomes more complicated the more properties you own. It is crucial to set up systems to be able to scale your investment portfolio. Your responsibility is to efficiently monitor and manage so that you can effectively maintain the value of your property and maximize returns.

Think about a juggler’s ability to spin dozens of plates on top of sticks with seemingly minimal effort. Most likely I would crash the first plate after mere seconds of spinning. But in time, with practice and the right technique, I can learn to spin multiple plates as efficiently as the juggler.

That’s how I learned to manage and track multiple properties. And so can you!

Look beyond your property manager’s abilities. Encourage suggestions and question the status quo. Ask yourself and your property manager:

- What can we do to improve rentability, revenue, occupancy, cash flow, property appeal, property value, longevity, and positive guest reviews?

- What can we do to decrease vacancy, repairs, expenses, wear & tear, utility usage, and negative reviews?

I no longer prefer to manage my own rentals. Self-managing properties could significantly increase your cash flow by eliminating the management fees. But there is a tradeoff. You are saving costs at the expense of your time and effort. We already discussed how precious your time is.

Determine what time commitment fits best with your life’s mission and purpose. Adjust accordingly and live your life on your own terms.

Here are some simple ‘excel’ tools that I use for efficiently tracking real estate investments:

GET/TAT/OTAT

All rental income in Hawaii is subject to paying General Excise Tax (GET). In addition, any rental income from rental-terms shorter than 180 days is subject to paying Transient Accommodation Tax (TAT) and, effective 12.14.2021, the 3% Oahu Transient Accommodation Tax (OTAT). Fines for late filing are exorbitant. The tax office could also put a lien against your property.

Don’t take chances. Stay organized, track the income and file on time every time.

Follow our video tutorial instructions on the easiest way how, when, and where to file: GET, TAT & OTAT – The Easiest Way To File & Pay

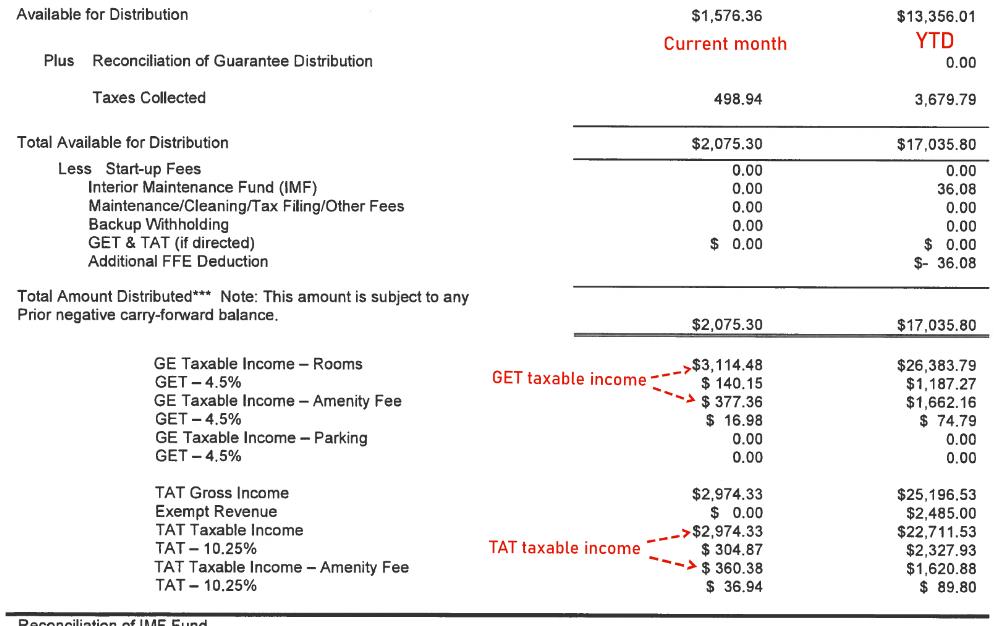

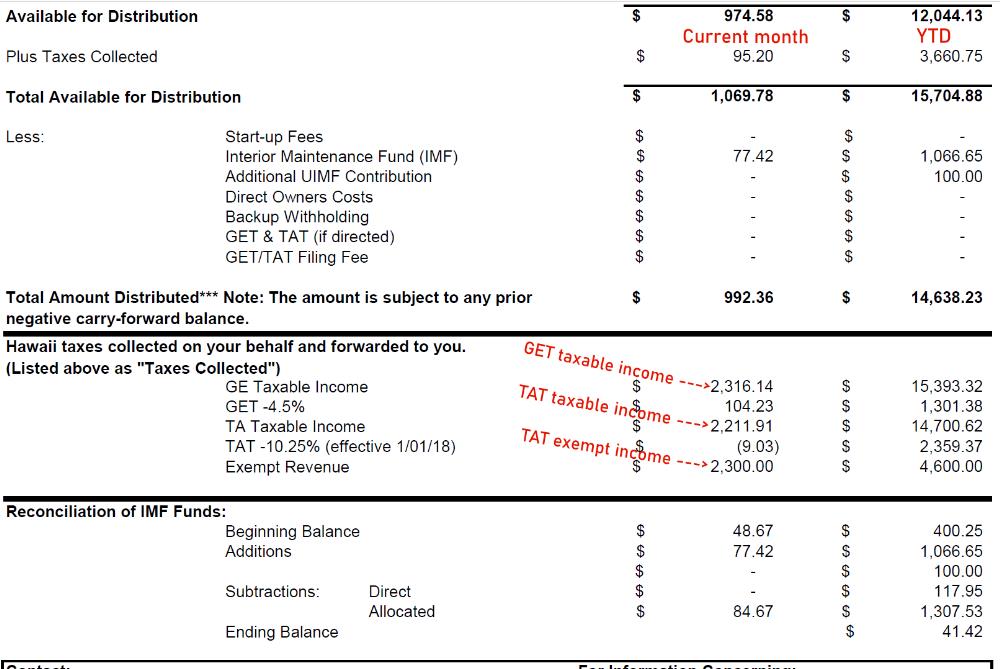

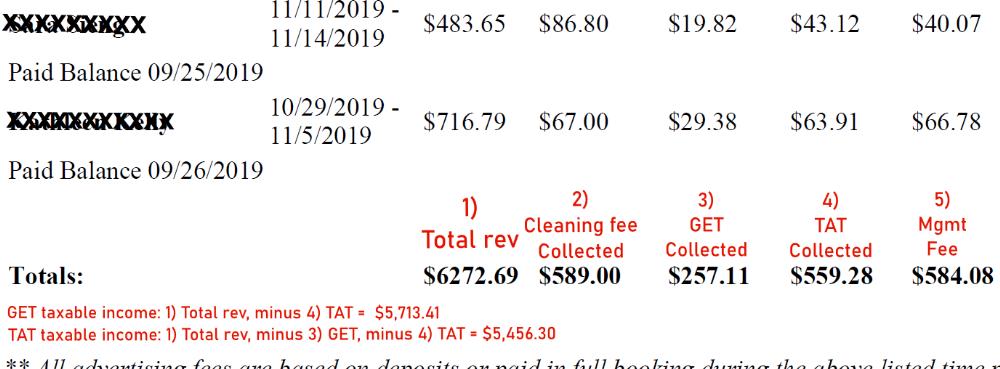

I consolidate all my Hawaii rental income onto one spreadsheet that automatically calculates the GET/TAT/OTAT. Regretfully, different property management statements show income and taxes in varying ways. You need to be certain to use the correct numbers.

To clarify, here are several sample short-term rental income statements from different management companies. My notes are in red:

Palms Waikiki – Sample Aqua Statement:

The sample statement shows a separate ‘amenity fee’ beside the taxable income. Both the income and the separate amenity fee are taxable for GET and TAT. Add both together and transfer to your master excel sheet, see more below.

See related article about the taxability of resort/amenity fees and cleaning fees here.

Aloha Surf – Sample Aqua Statement:

Here it does not show an itemized amenity fee. GET and TAT income are clearly marked. However, this sample statement shows $2,300 TAT exempt revenue (?) That is rare. In this case, it was a military guest that is exempt from paying the TAT tax.

For TAT tax filing, you insert the TAT taxable income under ‘GROSS RENTAL / GROSS RENTAL PROCEEDS (A)’ on your TAT form TA-1, just as you would normally do.

In addition, in the next column, you would insert the TAT exempt revenue under ‘EXEMPTIONS / DEDUCTIONS (B).’ On the next screen select from the dropdown menu the district ‘Oahu’ and the appropriate explanation for the exemption, in this case: ‘180 – Temporary Lodging Allowance for military (§237D-3(4)).’

The exemption cancels out the TAT revenue for that month. Make a note on your master excel spreadsheet.

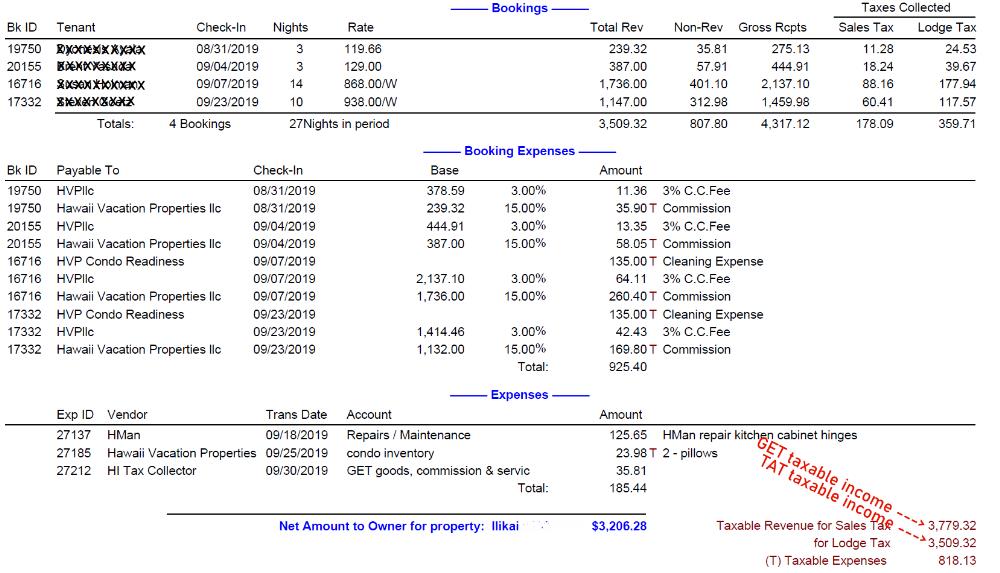

Ilikai – Sample Waikiki Beach Rentals’ Statement:

The sample statement shows total revenue and how much Cleaning and GET/TAT was collected that month.

To file your GET you calculate total revenue minus TAT collected and transfer onto your master GET excel sheet.

For TAT filing you calculate total revenue minus GET & TAT collected and transfer the number onto your master TAT excel sheet.

Ilikai – Sample Hawaii Vacation Properties’ Statement:

This sample statement clearly shows the GET income and the TAT income to file. Copy and paste onto your respective master GET and TAT excel sheet.

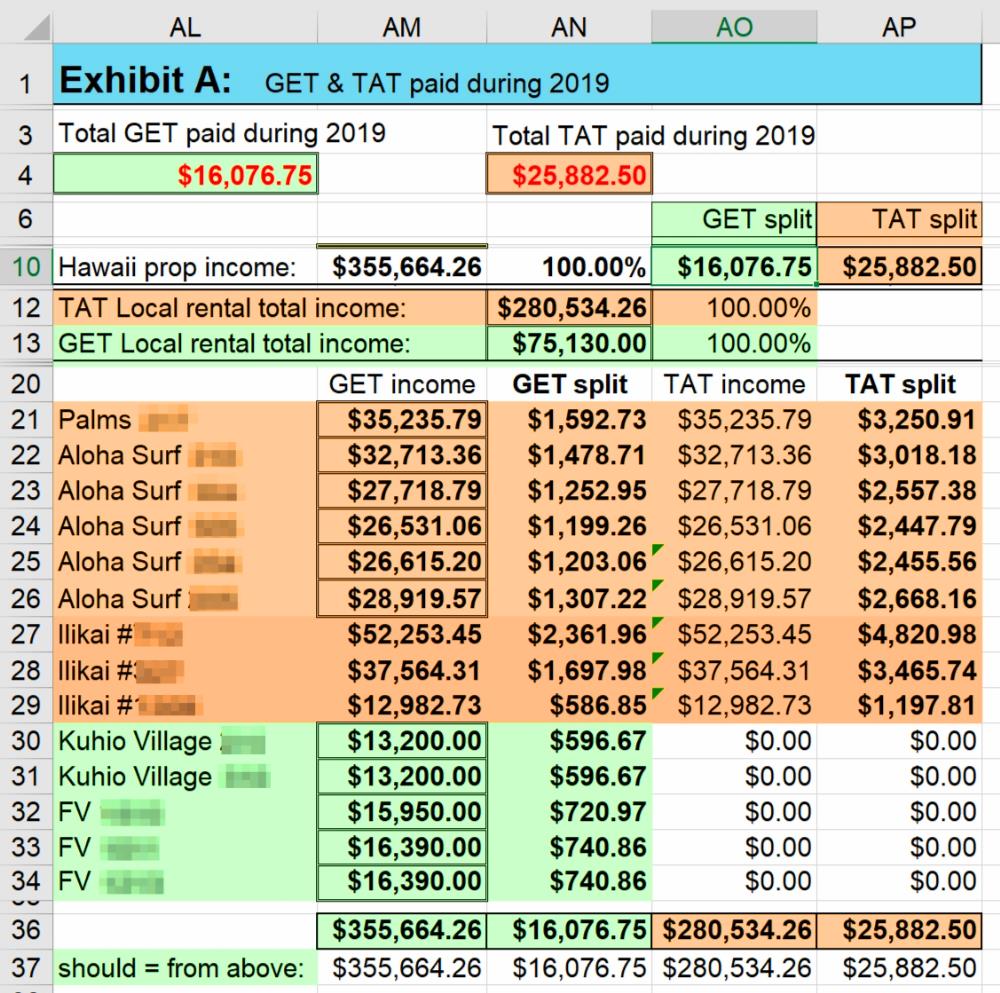

Sample GET Master Excel Tracking Sheet

On this simple grid, I list the Hawaii rental properties on the vertical axis and the month of the year on the top horizontal axis.

Rental properties with rental terms that are less than 180 days are grouped in the upper amber section. The subtotal shows in the amber line #18 across [e.g.: E18=SUM(E8:E17)]. The monthly subtotal income gets reported as ‘Transient Accommodations Rentals’ on the monthly filing Form G-45.

Review our tutorial again here. Online filing takes less than 5 minutes.

Rental properties with 180-day or longer rental terms are grouped in the lower green section. The subtotal monthly income gets reported as ‘Other Rentals’ on the same Form G-45.

Amber and Green totals add up to the Maroon total income and the purple line combines the calculated total GET tax due.

In addition, I use another similar TAT master excel tracking grid for my ‘Transient Accommodation Rentals’ only. The grid only shows the properties with rental terms that are less than 180 days. At the time of tax filing, the total TAT monthly income and the calculated TAT tax simply get copied & pasted onto TAT Form TA-1.

Yes, you get to deduct local taxes paid e.g. GET, TAT and OTAT on Schedule E of your federal tax return.

See related article: Real Estate Tax Benefits

Many years ago, a fellow realtor griped how cumbersome it is to calculate the respective GET and TAT that you get to deduct on Schedule E of your federal tax return. I use the following excel sheet ‘Exhibit A’ that automatically calculates that. It’s simple.

Sample GET & TAT Paid – Excel Tracking Sheet

Hawaii rental income (AM10=AN12+AN13) auto-populates from Q18 (Transient Rental income) and Q25 (Other Rental income) from the GET master excel sheet.

GET paid ytd (AL4=Q31) auto-populates from Q31 of the GET master excel sheet.

TAT paid ytd (AN4=AH22) auto-populates from AH22 of the TAT master.

The respective GET split for each property is auto calculated in the excel sheet, e.g. AN21=AM21/AM37*AN37.

The respective TAT split for each property is auto calculated in the excel sheet, e.g. AP21=AO21/AO37*AP37.

The respective GET & TAT split numbers get copied and pasted onto my Schedule E excel worksheet, see more below.

Once you set up your excel formulas properly then the calculated numbers flow automatically from one sheet to the next. This is a huge time saver.

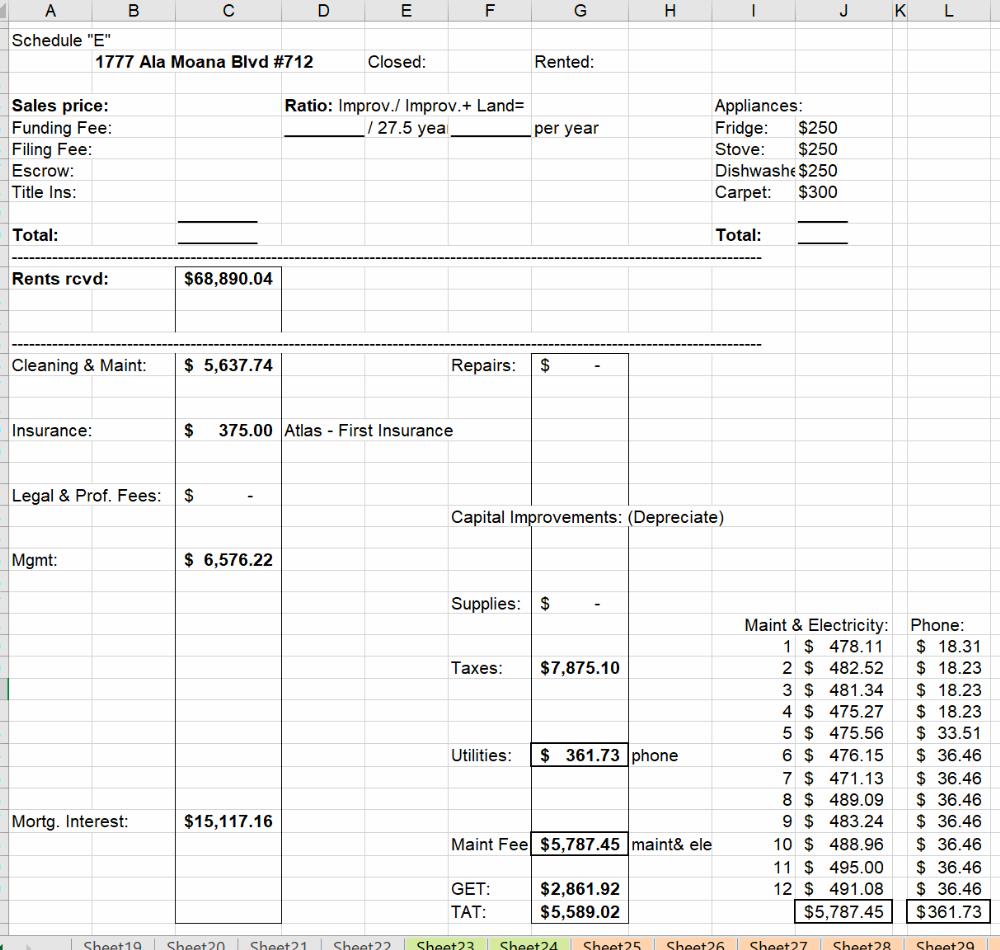

Schedule E

I log all current rental income and property expenses during the year in my ‘tax workbook Schedule E’ excel sheet. Each property has a designated page/tab that sort of mirrors the ‘Schedule E’ tax form.

Any expenses that are summarized on year-end management statements will be added to the excel sheet at the end of the year. The form automatically calculates the totals.

See where paid GET/TAT taxes show itemized on the bottom of the form.

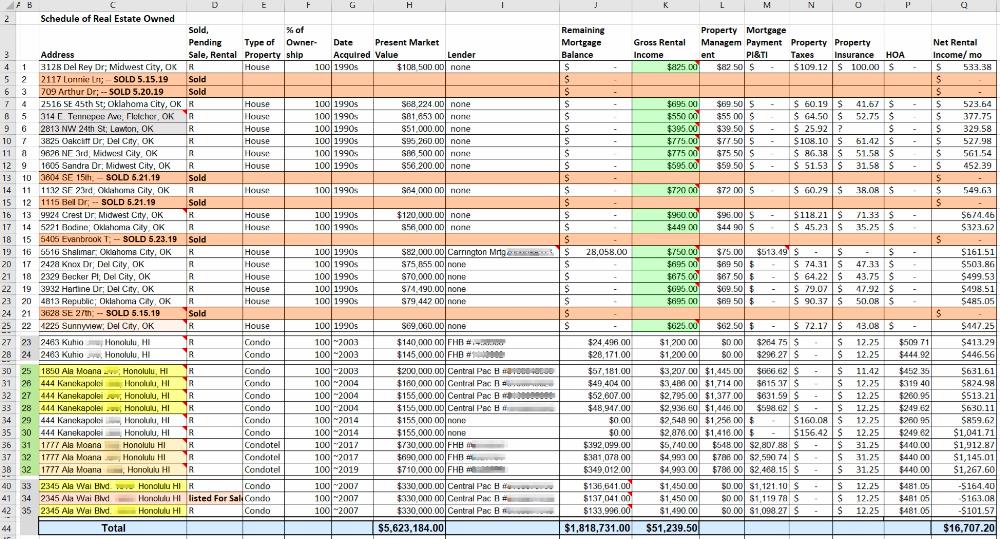

Summary ‘Financial Mind Map’ Spreadsheet

In addition to the GET/TAT and the tax workbook Schedule E, I use another spreadsheet that gives me an overview of all properties’ equity positions, remaining loan balances, income and expenses, loan info, insurance info, property tax info, management company info, and the net cash flow.

The sheet includes my retirement accounts, my banking info, and many notes on target prices, task items, conversations notes with property managers, insurance companies, vendors, etc.

The excel sheet is huge. It represents a mind map of my entire financial life with instant access to just about everything in one place. It calculates stock holdings, real estate equity positions, and net worth.

Perhaps you don’t have to get that persnickety to live a happy life. It is not necessary. There is however one more excel spreadsheet that is practical to maintain if you want to scale your portfolio.

Schedule Of Real Estate Owned

Whenever you apply for a new mortgage loan, the bank wants to see your ‘Schedule Of Real Estate Owned.’ If you don’t have a summary spreadsheet yet, I recommend using this simple format as that is the format that the bank prefers.

It shows the property addresses on the left vertical column, and it lines up on the top horizontal axis the info that the bank needs.

________________

May you find some benefit in what we share. Don’t get overwhelmed and discouraged. Start today with small incremental steps and improve from there.

Ask yourself: “What can I do today to simplify keeping track of my real estate investments and improve my life?”

You might come up with other ideas. Let us know in the comments below. We are curious to learn and grow, and your contributions might help others too! ~ Mahalo & Aloha