Condotels are hot! They offer a unique combination of maximum rental income potential with maximum rental flexibility. Because you are allowed to do short term (less than 30 days per tenant) vacation renting, your condotel investment property could serve a clever dual purpose:

A.) Generate maximum short-term vacation rental income, and

B.) Enjoy it as your personal vacation getaway.

Yes, you can have your cake and eat it too. At least with some properties, up to a certain extent, depending on expenses.

Every week we receive calls from Hawaii visitors wanting to buy the best vacation rental property, prompting us to clarify what to expect: Waikiki’s Condotel Reality – Cash Flow vs Lifestyle.

Some buildings that allow short term vacation renting have a hotel operator with a convenient lobby front desk. Subject to building restrictions, you may instead employ a 3rd party property manager, or manage the unit yourself. Check our Guide to Condotels which outlines buildings that allow short term vacation renting, requirements, fines, etc. Also check tax obligations on rental income.

Following are sample condotel units with respective income statements to analyze cash flow numbers:

1.) Trump Tower Waikiki – Studio:

We receive more inquiries about Trump Tower studios than any other condotel.

A typical smaller 386 -510 sq ft Trump Tower studio, in the -01 or -06 stack on the 8-16th floor with no ocean view sells for as low as ~$450K (2017).

Maintenance fees are ~$650/mo, property tax ~$500/mo (hotel-resort rate, if used as short-term rental less than 30 days per tenant).

Fixed expenses are ~$1,100 /mo (2017) regardless if your condo is rented or not.

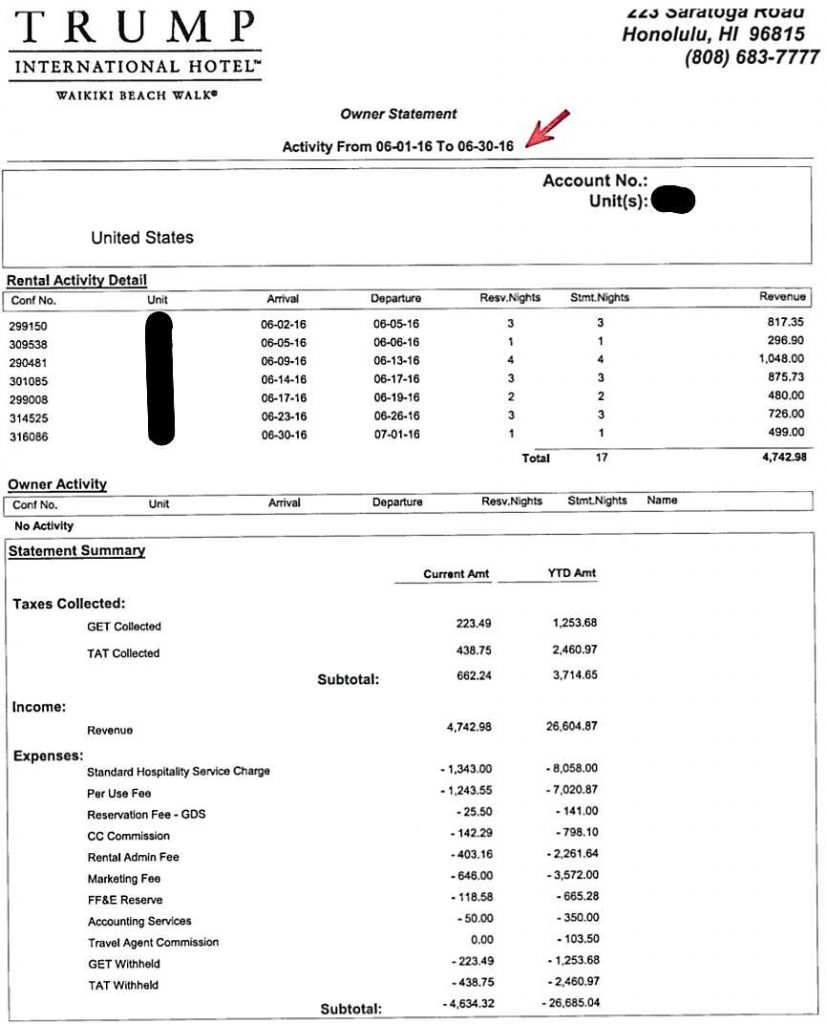

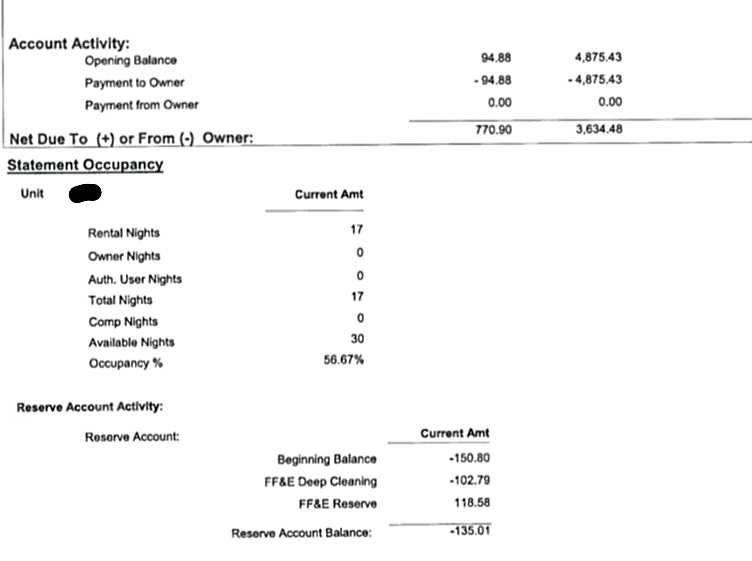

Sample income statement – Trump Tower – Studio, managed by Trump International Hotel shows:

June 2016 gross revenue: $4,742.98, plus $662.24 GET & TAT = $5,405.22

June 2016 expenses: $4,634.32 (Trump Intl files and pays GET & TAT for the owner)

$5,405.22 –$4,634.32 = $770.90 to owner June 2016.

After deducting the $1,100 / mo fixed expenses, your June 2016 net cash flow is negative $329.10

Based on 6 month ytd 2016, your annualized 2016 net cash flow is negative $5,931.04 ☹

2.) Trump Tower Waikiki – Deluxe 1-bedr, 2-bath + Den:

A typical Trump Tower – Deluxe 1-bedr, 2-bath + Den, with 1,115 – 1,154 sq ft, in the -11, -13 or -15 stack on the 8-20th floors with two ocean facing lanais sells for ~$1.65Mill (2017).

Maintenance fees are ~$1,735/mo , property tax ~$1,950/mo (hotel-resort rate, if used as short-term rental less than 30 days per tenant).

Fixed expenses are ~$3,685 /mo (2017) regardless if your condo is rented or not.

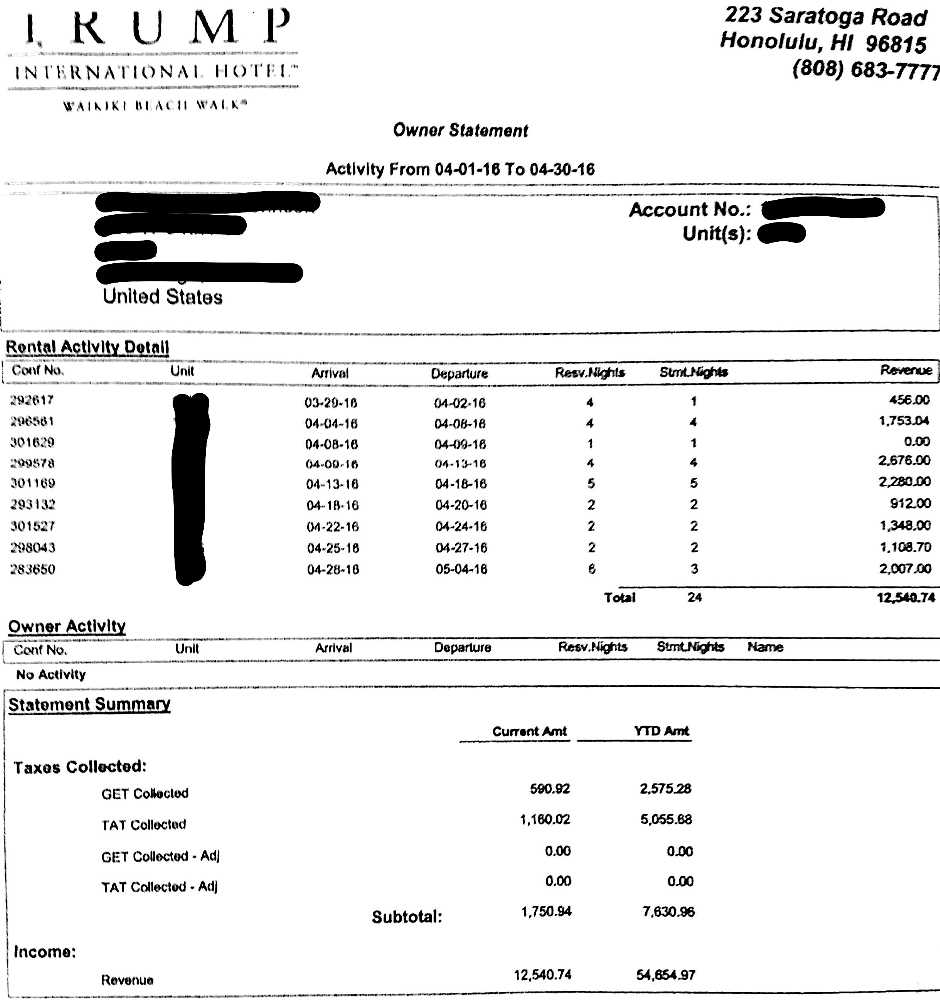

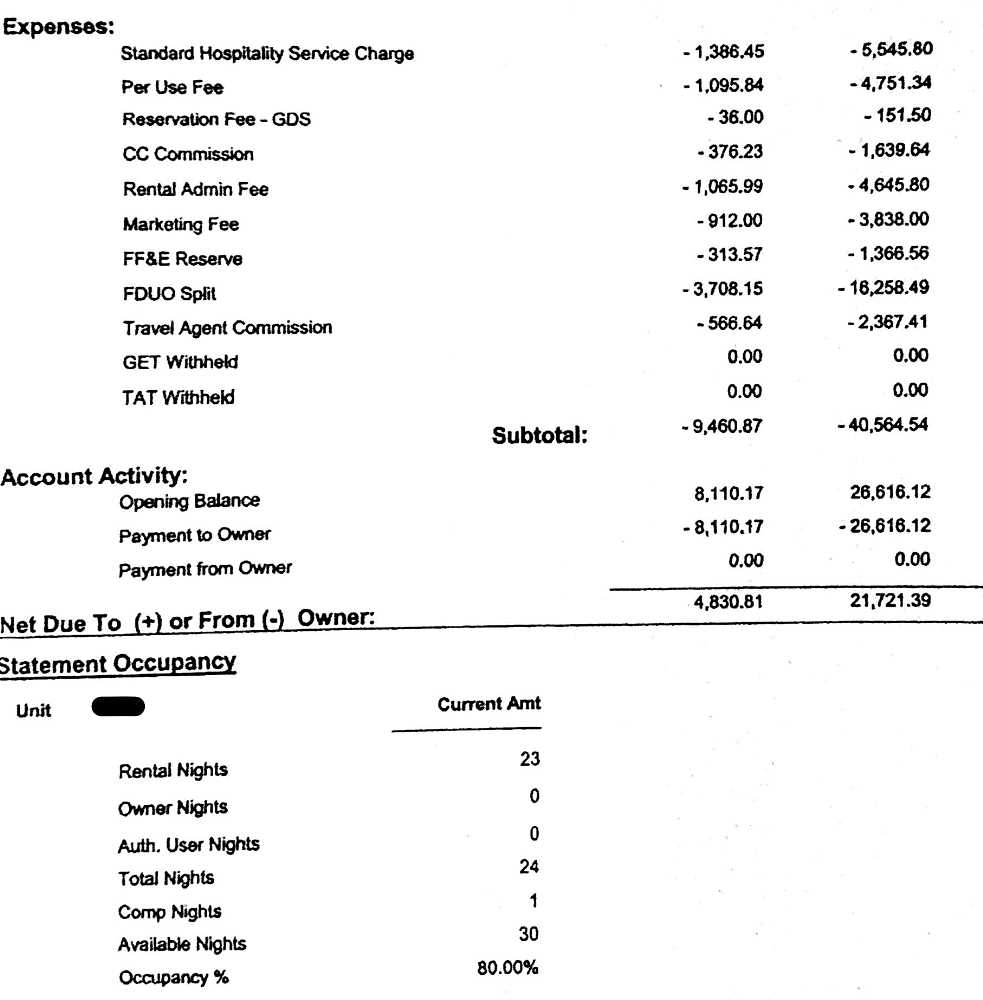

Sample income statement – Trump Tower – Deluxe 1-bedr, 2-bath + Den, managed by Trump International Hotel shows:

April 2016 gross revenue: $12,540.74, plus $1,750.94 GET & TAT = $14,291.68

April 2016 expenses: $9,460.87 plus $1,750.94 GET & TAT (owner pays directly) = $11,211.81

$14,291.68 –$11,211.81 = $3,079.87 to owner April 2016.

After deducting the $3,685 / mo fixed expenses, your April 2016 net cash flow is negative $605.13

Based on 4 month ytd 2016, your annualized 2016 net cash flow is negative $1.948.71. ☹

Lucky you don’t have a mortgage payment.

- Conclusion:

Trump Tower is a lifestyle choice, but not a cash flowing condo. Rental income does not offset the huge Trump Tower expenses. In addition, Trump has tight restrictions on allowing 3rd party property managers making the Trump Tower a poor choice for cash flow profit. – It is however a great property to vacation at and enjoy the VIP white glove service. A few owners even like living there fulltime.

3.) Palms Waikiki Studio:

A typical smaller 251 – 265 sq ft Palms Waikiki studio, with 1 Queen bed and Juliet balcony in the -09, -17, -23 or -29 stack with no ocean view on back side of the building sells for ~$190K (2017).

Maintenance fees are ~$454/mo , property tax ~$191/mo (hotel-resort rate, if used as short-term rental less than 30 days per tenant).

Fixed expenses are ~$645 /mo (2017) regardless if your condo is rented or not.

Other slightly larger Palms Waikiki units with two full beds rent better but also cost more and have higher fees.

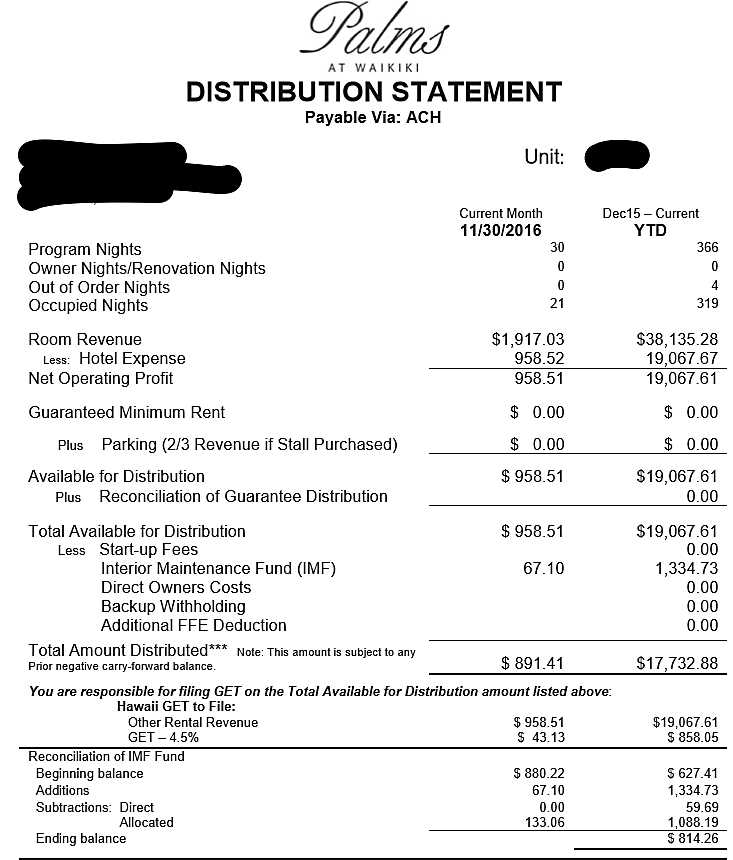

Sample income statement – Palms Waikiki studio, managed by Aqua shows:

Nov 2016 gross revenue: $1,917.03 (includes $43.13 GET, Aqua already paid TAT)

Nov 2016 expenses: $958.52 + $43.13 GET (owner pays directly) + $67.10 (IMF) = $1,068.75

$1,917.03 –$1,068.75 = $848.28 to owner Nov 2016.

After deducting the $645 / mo fixed expenses, your Nov 2016 net cash flow is $203.28

Your total 2016 net cash flow is $9,134.83. That’s a cap rate* of 4.807% ?

4.) Aloha Surf Studio:

A typical smaller 219 – 228 sq ft Aloha Surf studio, with 2 twin beds and no lanai on 2nd or 3rd floor in the -01, -02, -06, -07, -10, -11, -16 or -17 stack with no ocean view recently sold for $160K (Oct 2016).

Maintenance fees are ~$313/mo, property tax ~$146/mo (hotel-resort rate, if used as short-term rental less than 30 days per tenant).

Fixed expenses are ~$459 /mo (2017) regardless if your condo is rented or not.

Other slightly larger and higher floor units with either King bed + sofa, or, twin + full bed + sofa rent better but also cost more and have higher fees.

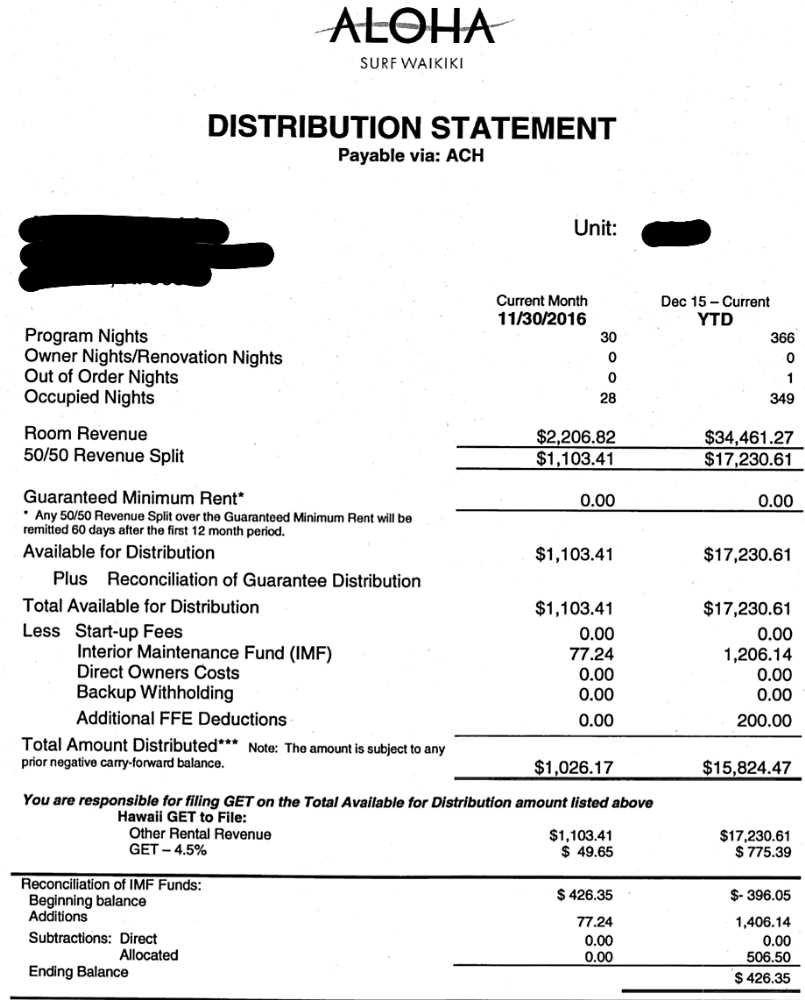

Sample income statement – Aloha Surf studio, managed by Aqua shows:

Nov 2016 gross revenue: $2,206.82 (includes $49.65 GET, Aqua already paid TAT)

Nov 2016 expenses: $1,103.41+ $49.65 GET (owner pays directly) + $77.24 (IMF) = $1,230.30

$2,206.82 –$1,230.30 = $976.52 to owner Nov 2016.

After deducting the $459 / mo fixed expenses, your November 2016 net cash flow is $517.52. (This is only the month of November)

Now check the right column: 366 program nights (Dec 2015 through Nov 2016) shows your $15,824.47 total 2016 gross distribution.

Minus $775.38 (GET) = $15,049.08 total 2016 net distribution.

Divide by 12 mo = $1,254.09/mo, minus 459/mo = $795.09/mo average net cash flow.

x12 = $9,541.08 annual net cash flow. That’s a cap rate* of 5.96% ?? – This is a rare exception and the highest cap rate we have seen in Honolulu for some time.

- Conclusion:

Both, Palms Waikiki and Aloha Surf’s smaller studios represent some of the best cash flowing condos we can find. Average daily room rates (ADR) and occupancy rates are high, while monthly expenses are reasonably low. However, if you plan to enjoy your condo for your next vacation, consider the tiny size.

These condotels look and function as economy hotel rooms with no full kitchen. A brief stay might be ok for the Spartan owner. An extended vacation stay might not.

5.) Ilikai 1-bedr:

A typical Ilikai 1-bedr with 500 sq ft interior and 120 sq ft open lanai often functions as a large studio. The vast majority of owners removed the original shoji screen doors between bedroom and living room.

There are over 1,000 Ilikai 1-bedr units in various conditions from excellent, newly remodeled to original outdated condition. There are three distinct sides to the building with either a.) lagoon / ocean views, b.) marina / ocean views, or c.) mountain views.

A typical lower floor Ilikai 1-bedr condo with ocean views starts selling from ~$600K (2017).

Maintenance fees are ~$440/mo, property tax ~$611/mo (hotel-resort rate, if used as short term rental less than 30 days per tenant).

Fixed expenses are ~$1,051 /mo (2017) regardless if your condo is rented or not.

Higher floor units might rent better but also cost more.

There are a dozen different property managers and hotel operators including Aqua managing Ilikai units. We like WaikikiBeachRentals as an efficient way to manage your Ilikai condo.

A typical Ilikai 1-bedr with ocean views managed by Waikiki Beach Rentals generates the following numbers:

2016 gross revenue: $51,498.40 + $7,190.20 GET & TAT + $4,554.00 Cleaning = $63,242.60

2016 expenses: $9,784.70 mgmt + $7,190.20 GET & TAT (owner pays directly) + $4,554.00 Cleaning + $840 electricity = $22,368.90

$63,242.60 – $22,368.90 = $40,873.70 to owner in 2016.

After deducting the $1,051 / mo fixed expenses (x 12 = $12,612) your total 2016 net cash flow is $28,261.70, or a cap rate* of 4.71% ??

- Conclusion:

Ilikai 1 bedroom condotels can produce great cash flow with relatively low fees. These units offer decent space, a full kitchen, awesome amenities and a rare direct beach access. Here is more about what makes the Ilikai special. Because the large ocean facing lanais provide a magical vacation experience, Ilikai ocean side units might represent the perfect blend between cash flow and lifestyle. For that reason, the Ilikai represents my personal favorite condotel building.

Choose your priority: Maximum cash flow, or maximum quality of personal enjoyment.

How much will you be using the condo for your own enjoyment? Mountain side units are on the noisy street vs ocean side units offer a serene magical vacation experience.

Ilikai mountain side units in the $450K range tend to have a better cap rate compared to Ilikai ocean side units at $600K+. Ilikai mountain side units rent for slightly less than Ilikai ocean side units, but are selling at a comparatively greater discount vs the ocean side units.

Rules of thumb to remember:

- Hawaii properties with cap rates close to 5% are extremely rare. The vast majority of properties in Hawaii does not even come close. The income numbers might be real but actual expenses are often understated. There is always the risk of an unexpected repair cost or an upcoming special assessment.

- If you are expecting better than 5% cap rate, you need to look somewhere else on the continental US. That is the reality of the Oahu market.

- 3x units @ $300K each, tend to produce a better cash flow compared to 1x unit @ $900K.

- Two full beds tend to produce better cash flow than one Queen or King bed.

* Cap rate is the cash on cash annual net return. E.g. a condo valued at $500K with a net operating income (NOI) of $25K / y has a cap rate of 5% ($25K / $500K = 5%).

Note: CAP rate calculations mentioned in this post are based on actual income statements. Past performance is no indication of future returns. We are a real estate brokerage selling real estate and not investments or securities.

Let us know what you think. We like to hear from you. Like, Share and Comment below. We are here to help. ~Mahalo & Aloha

Hi George, Thank you for the great article! My husband and I would like to purchase a property at Palms at Waikiki (#809, studio) as a vacation home plus investment property. The current maintenance fee is $582 per month and taxes is $311 per month. We planned to hire the hotel as to manage it. We read your article and found the cash flow of palms pretty discouraging. Has the data improved since you wrote the article or has it gotten worse? What do u think is the current return rate on this unit? Thank you so much!

Such a great article!

I was thinking of purchasing Ritz Carlton Residences in Wakiki and have a unit in rental pool, but unsure of all the fees or I’ll loose monies. I’m guessing it maybe the same as trump. Can you let me know? Much appreciated

Aloha Chantell!

The Ritz Carlton Waikiki and the Trump Tower Waikiki are fabulous lifestyle purchases. 🙂 However, both produce mediocre cash flow, if any at all. 🙁

Although the numbers in the article are a bit dated, the general principle still applies.

If you are looking to maximize cash flow, please let us know your budget, and we’ll share the best options available at that time.

Call us when you are ready to proceed.

We are here to help.

~ Mahalo & Aloha

Hi George,

Thank you for the article. It’s very informative. I am interested in Ala Moana Hotel, and want to know your thoughts. I am new to the condotel concept, and your article is very helpful. I am also hoping you can assist me in finding the right property in Hawaii.

Aloha Eve!

The Ala Moana Hotel maintenance fees are excessive.

That’s why there are many units for sale at prices that are similar to 2005 levels (!)

Review section #2, ‘Unique Market Volatility’ here:

https://www.hawaiiliving.com/blog/risks-of-short-term-vacation-renting/

Call us when you are ready to buy and we will help you identify the best suitable option for your budget and goals at that time.

We are here to help.

~ Mahalo & Aloha

Thank you for the guidance.

Do you have any data on Royal Garden ?

Aloha Gilbert Choi!

Royal Garden is a cute little boutique condotel.

I have seen some impressive income statements and others that weren’t.

Review how property management options and fees affect your cash flow:

https://www.hawaiiliving.com/blog/improve-condotel-income/

Call us when you are ready to buy.

We are here to help.

~Mahalo & Aloha

What about parking costs say at the Ilikai

Are there spaces available for sale or rent?

Aloha Robert Allen!

Like most condotels, Ilikai condos do not come with deeded parking stalls.

Guests can valet park for $28/day or rent a stall for $250/mo (2022) with a minimum stay of 2 months (based on availability).

However, any parking fees that the guest pays go to the parking attendant and do not affect the CAP rate calculation for the property owner. 🙂

Let us know if there is anything else we can do for you.

~ Mahalo & Aloha

Great article! Can you tell me if owners choose to check in for a week or two (or more) if they are required to pay the resort fee or if that can be waived for owners? Thx.

Aloha Mike Dee!

Which property are you considering? – If you stay in your unit you would need to pay the cleaning fee. Any additional fees depend on what extra services if any you use from the hotel front-desk operator regardless of how long your stay. Verify with the specific front-desk hotel operator in the building you are considering.

Btw, independent third-party property managers that we work with never charge a resort fee. More on property management options here: https://www.hawaiiliving.com/blog/improve-condotel-income/

Call us when you are ready to buy or sell. We are here to help. ~ Mahalo & Aloha

Aloha George,

Thanks for this very informative information.

Question: Why aren’t Fixed Expenses listed in the Owner’s Statement? (or are they?)

In addition,we are looking at purchasing a unit in Waikiki and have calculated a 10% CAP, which I know seems to good to be true. Especially since we do not know what the fixed expenses are. If I provide you with a few Owner Statements, can you provide your analysis as you have done for the other condotels in this article? Mahalo!

Dave

Aloha David!

Proper CAP rate calculation should include all expenses, including the fixed ones. Otherwise, your calculation will be off.

— Fixed expenses are ownership expenses regardless of whether you rent out your unit. These expenses include the AOAO/maintenance fee that pays for maintaining the building e.g. electricity for the common elements, water, sewer, trash collection, yard service, pool service, master insurance policy, etc… Other fixed expenses include city property taxes.

— Income statements only show the revenue, and the fees that the property manager charges relating to the management service provided.

I will send you a private email. We are here to help. ~ Mahalo & Aloha

Hi George,

Thank you for the great article! My husband and I would like to purchase a property at Palms at Waikiki (#809, studio) as a vacation home plus investment property. The current maintenance fee is $582 per month and taxes is $311 per month. We planned to hire the hotel as to manage it. We read your article and found the cash flow of palms pretty discouraging. Has the data improved since you wrote the article or has it gotten worse? What do u think is the current return rate on this unit? Thank you so much!

Hi George, another great resource article — thank you! Question for you on the cash flow WRT the Ilikai units. It seems there are 2 “classes” of condos there — upper floors 22-25 (+ 2nd floor) which were are the 2014 renovated/hotel “luxury suite” units, and the units on floors 3-21. The luxury/renovated units apparently have a requirement to use the hotel housekeeping/maintenance service, IF the condo is used as a short-term/nightly rental AND is not placed in the hotel management pool. Although those units sound very nice and upscale, I’m wondering if that arrangement could have a significant negative impact on cashflow, vs. purchasing a private “non-hotel” unit on a lower floor (even 21) and being able to use an outside company for advertising/management AND cleaning services. What is your opinion on that? Also, do you know if the cash flow is a lower in general, using hotel pools vs outside mgmt when allowed?

Aloha Raj Butani!

Correct. Ilikai units on floors 22-25 (+ 2nd floor) come with a ‘union/collective bargaining agreement’ deed restriction. If you short-term rent these particular units, you are required to use union hotel worker maid service for daily cleaning. The last time I checked, the cost was $84/d for the regular studio/1-bdr units and $110/d for the 2-bdr units. That is for every day rented (!) and it stifles your daily cash flow by that amount. ☹

The cash flow calculation in the article is for the regular Ilikai units without the deed restriction.

Let us know when you are ready to buy. We are here to help. ~ Mahalo & Aloha

Hi, what would be the cost of living in a studio at the trump hotel (for example) after you bought it and you don’t rent it out?

Aloha Cameron, If you live in a Trump studio and don’t rent it out you would pay maintenance fees and property taxes, which vary with each studio, depending on size and assessed value. You would also, like any other condo, be required to carry an HO6 (condo) insurance and pay electricity. Trump studios do not have washer / dryer in unit, so either you would have to pay for fairly expensive in-house cleaning services at Trump or you would have to run to a coin laundry. Parking: Complimentary when an owner is in town, however, when you are not in town, you have to pay for paying and that may be about $360 / month.

I’ve seen condotel price declined in 2014… what cause the decline? thanks!

Aloha Marna Gomez Koh!

I don’t recall condotel prices declining in 2014(?)

We don’t have graphs specifically showing only condotel valuations.

As a proxy, check graphs that show

a) historical visitor arrival numbers, as well as

b) condo prices here:

https://www.hawaiiliving.com/blog/covid-19/

I don’t see any price decline in 2014 (?)

Are you refering to a particular building only, or the entire condotel market?

E.g. the Ilikai underwent a major renovation in 2014. The top three floors were upgraded and sold as high-end units at the time competing against the regular inventory. Once the high-end units had sold, all Ilikai prices jumped significantly the following year.

– Let us know if there is anything else we can do for you. 🙂

Contact us when you are ready to buy and sell real estate.

That’s what we do best.

We are here to help.

~ Mahalo & Aloha

Great article. Thank you for objectivity and thoroughness of your analysis and presentation.

Aloha Nikodem Tomasz Pikor!

Thank you for your kind words.

Some of the numbers in the article have become a bit outdated, but the general principals still apply.

Tourism is currently on pause due to Covid-19.

Revenue & cash flow recovery will take some time.

Let us know how we can assist.

We are here to help.

~ Mahalo & Aloha

George,

Pause will last a few months. Recovery a few years at the very most.

Good investments require knowledge, courage and timing.

Talk to you soon.

Aloha Nikodem Tomasz Pikor!

You were right. The Hawaii condotel market already recovered by Summer 2021. Stay safe.

~ Mahalo & Aloha